Work and the DSP (Easy Read)

|

|

The Disability Support Pension (DSP) is paid by the government. It is for people with disability who cannot work or need support to work. |

What some people think

|

|

Lots of people who get the DSP think they lose money if they do paid work. This is not true. |

|

Sometimes people are told it is good to get a very low wage so they don’t affect their DSP. This is not true. |

You are always better off if you earn an income

|

|

The Australian Government wants people with disability to work. |

|

|

The DSP has rules that let you do quite a bit of work without losing your DSP. |

|

The rules say: |

|

|

|

|

|

|

You are still better off. |

How does earning an income affect my DSP?

|

|

Some of this information may sound confusing. It is okay to get someone to help you understand it. |

|

|

The DSP rules say how much you can earn before your DSP changes. |

|

In 2020 you can earn $178 each fortnight from having a job and your DSP stays the same. |

|

|

|

For every extra dollar you earn after $178, your DSP will go down 50 cents. But this means you are still 50 cents better off for every extra dollar you earn. |

|

|

Here are some examples:

That means you get some DSP + $578. |

|

|

Can you see that working means you end up with more money? |

The 2-year rule

|

If you do earn too much, you still won’t lose your DSP. But your DSP money can be stopped for 2 years. This is called the 2-year rule. |

|

|

|

The 2-year rule is a good thing. It means you can earn more money without losing your DSP. If you lose your job or your income drops:

|

|

|

Your DSP money can be stopped for 2-years if you:

or

|

|

The cut-off limit is the most money you can earn before the government stops your DSP money. |

|

|

|

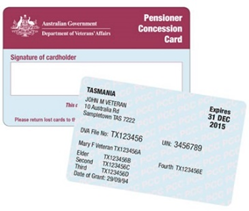

You can have the pensioner Concession Card for 1 year after your DSP money stops. Concession Card is sometimes called a pension card. It lets you get special benefits like cheaper medication. |

|

An example of the 2-year rule is: |

|

|

|

Jurrah is 22 and is on a DSP. He got a job in open employment. |

|

He packs flowers to send from the warehouse to the shops. He is on an award wage. |

|

|

Because he works 30 hours each week, Jurrah’s DSP was stopped. But Jurrah was paid more than his pension for working. And Jurrah got to keep his concession card. |

|

|

After 6 months, work got quiet. Jurrah’s hours went down to 25 hours each week. Jurrah told Centrelink this. His DSP money started again; Jurrah also still got his pay from work. |

|

|

Jurrah was always better off working. |

|

Here is an example if you have worked more than 29 hours per week for more than 2 years. |

|

|

|

Amber is on a DSP. She gets a job in an office working 34 hours a week. Her DSP money is stopped because she works more than 29 hours per week. |

|

|

Amber still earns more money than her DSP. |

|

|

After 2 years Amber’s DSP is cancelled. If Amber’s hours go down, she will have to reapply for the DSP. |